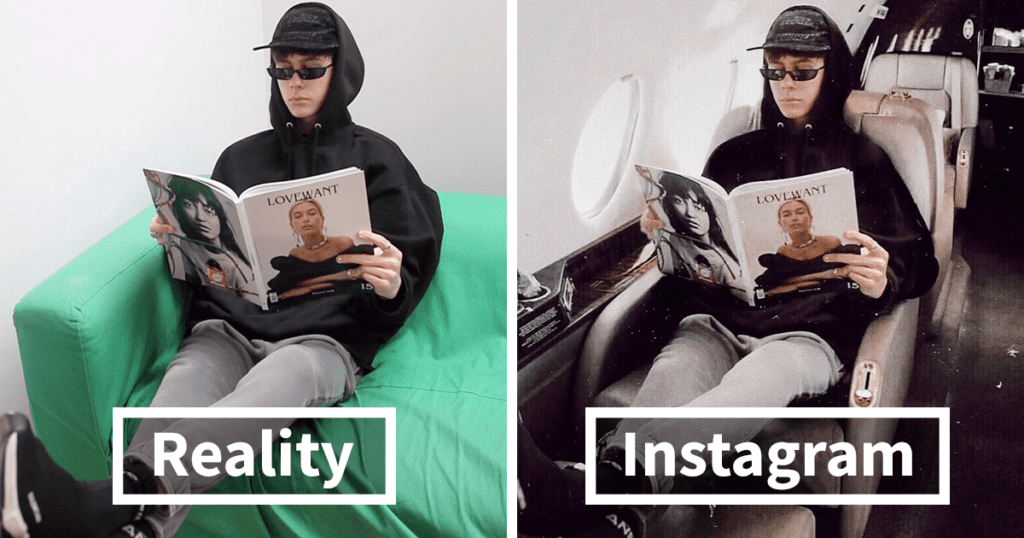

We are in the middle of a fake wealth epidemic

People are obsessed with wanting what they cannot afford. We have become a society of instant gratification. Wanting fully loaded vs. what we can afford. Buy it now, and pay it off over time. Social media, Hollywood and even those around us have driven us to increasingly have champagne taste over the past several years. Look at what Starbucks has done to upsell us from what used to be a cup of coffee at home to a $6-7 designer latte. The problem is that people now have those champagne tastes, but the average household is still on a beer budget, not earning as much as this urge to acquire the finer things in life. But, are they really the finer things? Is it really real if it is not yours to begin with?

The truth is, the people with the lifestyles you are chasing and aspiring to be are most likely not financially secure. It is all a show. Remember the sitcom Friends? You barely saw them working, and when they were, they were waiting tables or holding other low-wage jobs. Yet, they all managed to live in a lavish apartment in NYC. Not very plausible, yet that’s the image my generation grew up chasing.

Avoiding the need to look to others for validation and realizing that fake wealth is not real will help you on your journey to financial independence.

Here are 5 reasons to avoid fake wealth:

Reason 1: Big houses and fancy cars seen on social media are likely all a facade.

The average square footage of a house in 1940, around the time my house was built, was just under 1,200 square feet. Today, the average house size in the United States is nearly 2,300 square feet…more than 2 times larger. Yet, the size of the average family has shrunk over that same time period. My grandmother’s sister raised 12 kids back in the 1950s and 60s in a 3 bedroom bungalow. Yes, 12 kids! I’m sure you have stories from your own family history like this. Probably not 12 kids, but you get my point.

Houses have exploded in size. And with that, home debt has exploded as well. 30-year mortgages didn’t even become popular until the 1970s, yet they are now the staple in home mortgages. Why? Because we have adopted a bigger is better mantra, and you have to pay for bigger much, much longer. People see their role models (maybe parents, friends, influencers, etc.) buying larger, and they follow the crowd, thinking this will make them happier. The result is a pile of debt and a house and cars that are never paid off. In fact, the house (in addition to credit cards) will likely be used as a piggy bank to fund a fake lifestyle for their entire lives.

Resist the temptation to look at others for how you live your life. You will constantly be disappointed and stressed out about how to make ends meet every month.

Reason 2. The pressure of “keeping up” is bad for your health.

If you fall prey to modeling what you should have, what you should buy and what you should do after what other people are doing, it will cause a great amount of disappointment and stress. Find contentment and a sense of ‘enough’ within yourself, or you will constantly be striving for something that you will never attain. If you do attain what others have that you don’t currently have, and it is done in a “fake wealth” way, that added stress to maintain the lifestyle can cause emotional stress which then leads to physical health issues. Avoiding the pressure of “keeping up” altogether will keep you healthier in the long run.

Reason 3. A “you only live once” attitude won’t pay for your long-term care. It won’t pay for wages in your retirement either.

You’ve likely heard the term YOLO, meaning You Only Live Once. The idea of YOLO as it relates to spending is that one should “live large” and do big, splashy things in order to live in the moment. You never know how much time you have on this earth, and you should enjoy it while you’re here, right? This type of living in the moment, however, comes at a BIG cost. When you spend everything you earn and more to “live in the moment,” you are stealing from your future.

Aging is costly. Health care and long-term care costs are big expenses. Social security only goes so far for income in what are supposed to be your golden years. How will you earn money to make your expenses? An older body can’t work forever. The average life expectancy is much longer than it has been in the past. During your wealth accumulation years, if you are not more disciplined with finances, your later years will be filled with regret and “if I could turn back time” (cue your Cher voice). Prevent that from happening by being at least a bit more disciplined during your healthy, younger working years.

Reason 4. Living with fake wealth isn’t a good example for your kids.

If you have kids, at least one of them is going to grow up and copy how you manage life. Do you want them to spend mindlessly, live in significant debt, not have an emergency fund and stress out about money because of how they’ve seen you live? Show your kids how real wealth gets made, and you are setting them and future generations behind you up for success. Can you imagine that legacy? You have the power to create that legacy. If your parents were horrible with money, it doesn’t mean you are destined to be horrible with money. All of this is within your control. You can change the trajectory moving forward and leave behind a legacy that is about much more than the money.

Reason 5. Living in the moment or YOLO means much more than money.

Living in the moment or “you only live once” doesn’t need to be a financial thing. It means so much more than money. Living in the moment means being present for yourself and being present for those you love. Not just physically being present, but mentally being present. It can also mean doing exhilarating things that remind you that you’re very much alive. That doesn’t require spending thousands of dollars mindlessly. It can be training and running a marathon. Get down on the floor and actively play with your kids vs. being distracted by your phone. YOLO is not financial irresponsibility. It is doing real things that remind you that you are living…right in this moment.

Strive for real wealth. Save and buy only the things you can afford.

Real wealth means you have a healthy retirement nest egg, a 6+ month emergency fund, a house with substantial equity that is easily affordable, a paid off car and NO credit card debt. Real wealth is when you’ve saved an amount of money that is 25X your annual expenses, making you financially independent. It takes a lot of discipline to get there and stay the course. But, the good news is that it is extremely possible if you work at it. And it is extremely possible for all income levels. All of this is relative and very much achievable if you avoid the pitfall of looking to others for validation.

Until next time.