It is true. I haven’t had a pay raise in 10 years. Am I mad about it? No. The truth of the matter is that I prefer it that way. Before you call me crazy, hear me out. My wife and I have made a conscious choice to not get a pay raise for the past decade. Why would someone in their right mind forego pay raises for that many years you ask? It is simple. I and my family live on the income that we made over 10 years ago, and everything else goes to savings and investments. We pay ourselves first and save our raises. We have made a concerted effort in avoiding lifestyle creep over all of these years.

What is lifestyle creep?

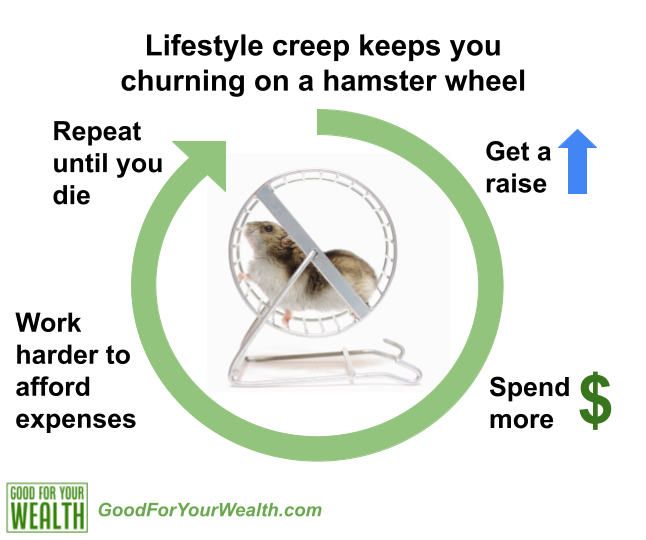

Lifestyle creep, also known as lifestyle inflation, is one of the biggest and most overlooked barriers to wealth. It is a phenomenon that occurs when a person gets a raise or comes into an increased amount of money periodically, and they spend more and more over time as they get those increases in income.

You’ve heard of the Joneses, right? Keeping up with the Joneses was a thing well before we kept up with the Kardashians. The real story of the Joneses is that they are in debt up to their eyeballs. They are on a chronic hamster wheel. Whenever a raise is earned, more money gets spent. Their lifestyle gets more extravagant, the house gets bigger, their car goes from modest and used to fully-loaded and new, they start dining out more often (because they have no time to cook). They get a boat, some jet skis and other toys because that’s what consumers do. They think having these things will make them happy, and maybe it does in the beginning.

Mr. and Mrs. Jones will sadly churn through this cycle on the hamster wheel until they retire late, likely still in debt. And, by the way, all of the money the Joneses have spent over the years has caused them stress which has led to some chronic health issues. Happy retirement Joneses! Some retirement, huh? The key to preventing this is by avoiding lifestyle creep altogether.

How to avoid lifestyle creep.

Temptation is all around us. Society and advertising tells us what we should be doing to live the fullest life. Most of it involves spending lots of money. It is especially hard to avoid lifestyle inflation when our closest friends are acquiring things frequently. There is a bit of FOMO (fear of missing out) that occurs. If you have a desire, however, there are several ways to avoid lifestyle creep. I’ve covered many savings techniques and frugality ideas in previous articles.

#1 Change your mindset to avoid lifestyle creep.

Material things are not going to make you feel better if you don’t already feel great and are confident with yourself. Avoiding lifestyle creep will take an adjustment and force you to think about where you put the most value. If you think on it for a bit, the thing you most value probably won’t be something you bought. Avoiding lifestyle creep will require changing your mindset and not being afraid to be different from the crowd. It is about rocking that 7+ year old car while others are leasing and churning through new, for example. It is about being content and understanding what is enough.

#2 Automate your savings.

Avoiding lifestyle creep requires that you make modifications to force you into new behaviors. Automating your savings is one of those modifications. When you establish automated savings before you see your paycheck, for instance, your brain begins to adjust to that new normal. Over my time in corporate america, I’ve heard colleagues express excitement for payday, likely living paycheck to paycheck. I love payday, don’t get me wrong, but when you automate your savings and build a snowball of savings over time, when payday occurs becomes less relevant. You will blink, and through the power of compounding, find yourself in a very comfortable financial situation.

“You’re better off robbing from yourself today to secure your future self than robbing from your future self to pay for an elevated lifestyle today.”

#3 Max out your retirement savings.

Similar to automating your savings, setting up a plan to maximize your retirement savings will help you stash aside money for your future. Once you set it and invest in the right way, you will find that your wealth continues to grow at a feverish pitch. You’re better off robbing from yourself today to secure your future self than robbing from your future self to pay for an elevated lifestyle.

#4 Set a budget.

Find out what your monthly base expenses are. I have always found it helpful to start with a zero-based budget, meaning start with the things that you really need, such as house, utilities, etc. Then go through the exercise of figuring out what you care about. For instance, it is important for us to enrich our kids lives, so we have one daughter in vocal lessons and another in gymnastics. We plan for that as part of our monthly budget. It is also extremely important for us to have travel experiences. We take epic trips pretty regularly. We put value in that, so we budget for it. What I don’t budget for is a boat, new cars, regular dining out and so forth, because I don’t put a ton of value into those things.

#5 When you get a raise, immediately up your savings (or apply it directly to debt)

This is where I started in the beginning of this article. Getting into the habit of treating that raise as a way to incrementally build your wealth is so important. Building your wealth happens by paying off debt or increasing your savings. Your savings rate is the biggest factor in your ability to build wealth. And when you save more, it compounds.

Ever hear of the rule of 72? If you divide 72 by the percentage of interest/return you expect, let’s say 10% (FYI, the S&P index over the past 30 years has averaged over 10% annually), it gives you the amount of time it will take to double your original investment (in this case, 7.2 years). So, even if you get into the habit of at least taking half of that raise and investing it instead of spending, you will be in great shape.

What kind of life am I really living without increasing my lifestyle over time?

Let me first say, you can increase your lifestyle over time. You have to define what “lifestyle” is to you. Ten plus years ago, I wasn’t doing the epic vacations like I do today. As I’ve gotten older (and wiser hopefully), I’ve put more value on experiences. I live in a very strong and active community where my kids can walk to visit friends, walk to the library and walk to school. We attend community events, go on hikes, have family game nights, order carryout from our favorite places every Friday and have family movie nights as well. We have a very strong, vibrant lifestyle.

If you put your money toward the things you truly (and I stress truly) value most, and take it away from the things you don’t (but maybe think you do), you will find your savings. And making changes to avoid lifestyle creep will be less disruptive to you.

Some things to ponder at your next raise

If you’re anticipating a raise this year, plan on doing something different with it. By the way, this year is anticipated to be a year of bigger raises. Make a plan for that upcoming raise, other than spending it. If you have high-interest debt, up the amount to pay it down or pay it off. If you don’t have debt, apply that raise to your savings if you can. If you are interested in exploring financial independence further, check out these books. You will thank yourself later and realize how good for your wealth it really is.