I’ve often heard from older individuals, “if I had only started saving earlier in life, I wouldn’t be stuck doing [fill in the blank].” What I hear in these words of regret is a bit of wisdom; an understanding of the value of time and its impact on money. Too often, we disregard the lessons that those before us have learned throughout their lives. There’s so much to learn from those who have made mistakes and lived to tell. From a financial standpoint, it is clear that the biggest gift you can give yourself is saving early and often, putting your money into quality investments. The second biggest gift (for those not so young) is to start saving now, even if you think it is too late. Why? There is one clear answer – the power of compounding. Compounding is your best friend on your journey to financial independence.

Compounding explained

Simply put, compounding occurs as follows:

- You save/invest money (your principal)

- It earns interest or returns (your earnings)

- That interest or return gets added to your principal or starting amount

- That new combined total (your principal and interest/returns) makes even more money

- Rinse and repeat. The longer you let it go, the more it grows year after year.

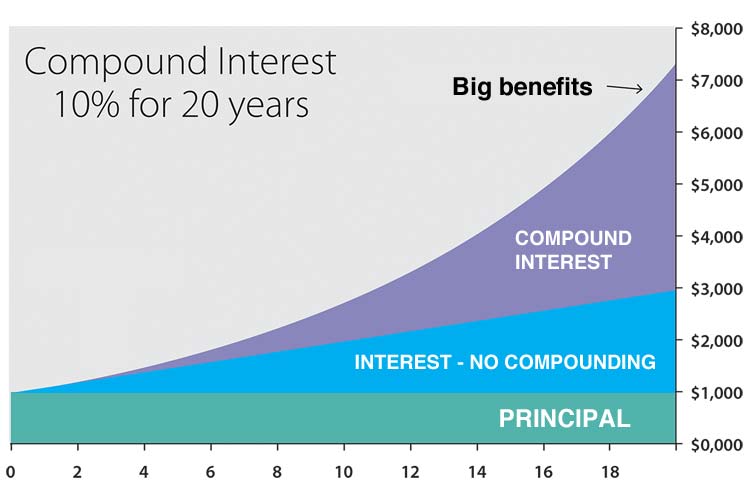

What starts out as a snowflake in the beginning turns into a very large snowball years down the road due to the power of compounding. The chart below shows the impact of $1,000 put into an investment earning an average of 10% per year over 20 years. Just that $1,000 with no additional investments made over that time grows to over 7X the original amount. Why? The power of compounding baby! The total amount of money earned through compounding eventually eclipses the original principal amount you put in. In other words, it is the compounding that begins driving the growth of your wealth. The original principal or starting amount was the seed. The compounding is the Redwood tree that grows from it.

Why it is important to start saving early – a tale of two investors

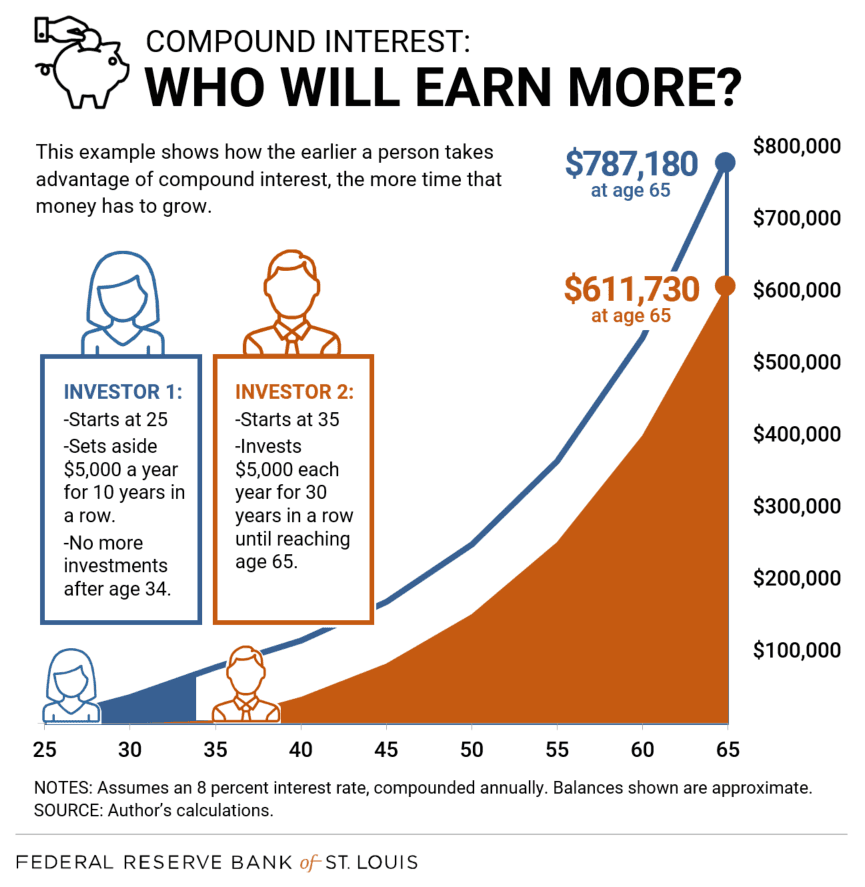

As I said earlier, it is never too late to get started in saving and investing, but the biggest benefits will come to those who start earlier. Time is on your side with compounding. By starting earlier, with more time ahead of you, it is possible to actually save less of your own money and still end up with more in the end versus a person who starts saving and investing later. Why? You got it…the power of compounding.

The example below illustrates two different investors. One who started at 25 years old and another who started at 35. The 25 year old saves $5,000 per year for 10 straight years, then abruptly stops. The 35 year old on the other hand, starts later at 35 and continues for 30 straight years, investing $5,000 each year over those 30 years. Because of the head start and the power of compounding, the 25 year old ends up with more in the end, despite saving only $50k of her own money versus the 35 year old who invested $150k of his own money.

Compounding has the reverse effect with debt

Just like compounding occurs on your savings and investments, the same happens with credit card and loan debt, except in the reverse direction. If you have credit card debt, for instance, and do not pay your bill off completely each month, the money you owe month after month is compounding. And guess what? Credit card interest is typically compounded daily. This means your credit card company is charging you interest daily on your unpaid balance. If you are making minimum payments on credit cards, this is creating a huge snowball, but a snowball of debt. And once the debt starts, it grows much more quickly than your savings will. The average stock market returns over the past several decades is roughly 10% per year on average. The average credit card interest rate? Nearly 20%! Wouldn’t you rather be putting your hard-earned money into something that will compound you to the moon versus into the ground?

3 steps to take now to cash in on the power of compounding

1. Start saving and investing as early as possible.

As you saw from the examples above, getting into the habit of saving and investing earlier (even with small amounts) will do wonders for your wealth over the course of several years. By getting an early start, you will reduce the need to invest a larger amount later in life to then end up with the same result. Again, start with small amounts if needed. Just get into the habit. Time and compounding together are a powerful force.

2. Automate your savings.

Pay yourself first and automate your savings. I get paid bi-weekly. Every two weeks, several chunks of money come out of my pay before I even see it….401k, HSA, IRAs, brokerage account and some charitable contributions to name a few. I never see the money. I just see the remainder that gets deposited to my checking account for living expenses, entertainment and so forth. It is good to get into this habit of automation. Paying yourself first in this way becomes a muscle that you exercise, and once it has been in place for a while, there’s muscle memory built. You eventually don’t even think about it.

3. Avoid debt (at least consumer debt). It will drag you down.

This is pretty straightforward, but debt is a drag on your wealth. Typically, interest rates you’re paying are greater than the interest or returns you could get from investments. Therefore, debt has the ability to grow much faster than your assets if you’re not careful. For this reason, staying within your means and paying credit cards off monthly is recommended. Instead of taking out large car loans, try to get by with a car you can afford to purchase with cash. Paying interest on a depreciating asset, such as cars, clothing, food, etc. really does not make a lot of sense when you think about it. That $100 dinner out that you put on your credit card without paying it off quickly becomes $120. This can be avoided with a proper budget.

Compounding is good for your wealth

In closing, compounding has the power to take a small initial investment and supercharge it to something much bigger. Add to that some reoccurring monthly ‘set-it-and-forget-it’ investment deposits and you are well on your way. Start early, but even if you’re past the point of young, get started ASAP. It is never too late. You can still benefit from the power of compounding.